Aethon Energy Management to acquires Tellurian’s upstream assets for $260 million

(WO) – Tellurian Inc. and Aethon Energy Management LLC announced an agreement for Aethon to acquire Tellurian’s integrated upstream assets for $260 million, alongside a Heads of Agreement for Aethon to purchase two million tons per annum (MMtpa) of liquified natural gas (LNG) from Tellurian’s Driftwood LNG plant.

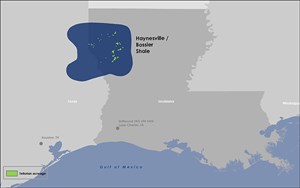

The assets will expand Aethon’s footprint in the Louisiana Haynesville and Bossier shale basins with approximately 31,000 net acres, including gathering and treating systems that have capacity for up to 100 MMcfd that will bring Aethon’s pro forma gathering and treating capacity to over 3 Bcfd across its assets.

The Heads of Agreement contemplates the parties negotiating a 20-year offtake agreement which would be indexed to Henry Hub plus a liquefaction fee, with appropriate credit support, to provide the basis for project financing of Driftwood LNG. Aethon will continue to explore additional opportunities to bring value to Driftwood LNG following the transaction.

Tellurian Executive Chairman Martin Houston said, “Today’s agreements with Aethon take us several steps closer to developing the Driftwood LNG project, for which Aethon is a vital partner. The offtake agreement for two MMtpa provides the foundation to accelerate Driftwood and demonstrates that we have successfully aligned our commercial offerings to meet the needs of potential customers.

“For Tellurian, the proceeds from the sale of our upstream assets allow us to retire senior secured notes and strengthen our balance sheet for the long term. This is an important moment for our company, as Tellurian continues to make progress against our strategic plan.”

“The expanding scale of our vertically integrated business continues to deliver capital efficiency and industry-leading margins as we work to accelerate the role of natural gas in the broader energy transition,” said Aethon Energy Chief Executive Officer Albert Huddleston.

“This Fund II and Fund III acquisition provides complementary growth opportunities alongside our extensive upstream and midstream footprint in the Haynesville with more than 20 years of existing inventory life. Our partnership with Tellurian will provide our downstream LNG customers with the lowest methane emission intensity in North America.”