Vermillion closes acquisition of Westbrick Energy

Vermilion Energy Inc. has closed its acquisition of Westbrick Energy Ltd. for a total consideration of $746 million USD ($1.075 billion CAD). The deal was previously announced in December 2024.

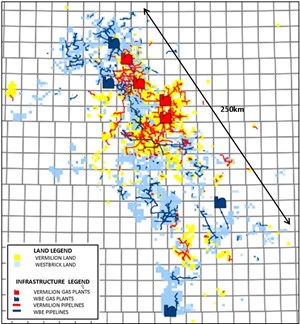

The acquisition adds stable annual production of 50,000 boed(1) (75% gas and 25% liquids) and approximately 1.1 million (770,000 net) acres of land in the southeast portion of the Deep Basin trend in Alberta, and includes four operated gas plants with total capacity of 102 MMcfd. This footprint is contiguous and complementary to Vermilion's legacy Deep Basin assets, providing significant operational and corporate synergies. Vermilion has identified over 700 future drilling locations on the acquired acreage, across multiple zones including the Ellerslie, Notikewin, Rock Creek, Falher, Cardium, Wilrich and Niton formations, with half-cycle IRRs ranging from 40% to over 100% based on estimates provided by McDaniel & Associates Consultants(2). With this depth and quality of inventory, Vermilion expects the acquired assets to have the ability to maintain flat production for over 15 years while generating significant free cash flow(3) to enhance the company's long-term return of capital framework.

See also: Vermilion Energy announces $1 billion deal to buy Westbrick Energy

Included in the agreement was an option for Westbrick shareholders to elect to receive up to a maximum of 1.7 million Vermilion common shares not to exceed $25 million in value as a portion of the total consideration. Certain shareholders of Westbrick have elected to receive Vermilion common shares totaling 1.1 million shares at a value of $14.2 million. The remainder of the consideration for the acquisition will be paid in cash, funded through cash on hand, Vermilion's new $450 million term loan, and Vermilion's undrawn $1.35 billion revolving credit facility.

Vermilion announced it will provide an updated 2025 budget and financial guidance reflecting the increased scale of the company following the acquisition with the release of its Q4 2024 results on March 5, 2025.

- Anticipated 2025 production from acquired assets, based on company estimates at February 26, 2025. Full year production estimates may not align with Company 2025 guidance, which will reflect post-close production contributions.

- Estimated gross proved, developed and producing, total proved, and total proved plus probable reserves as evaluated by McDaniel & Associates Consultants Ltd. ("McDaniel") in a report dated December 17, 2024, with an effective date of November 30, 2024 (the "McDaniel Reserves Report"). Three consultant average October 1, 2024 pricing assumptions used in reserve estimates as follows: 2025 WTI US$72.00/bbl, AECO C$2.50/mmbtu, CAD/USD FX rate 0.747; 2026 WTI US$74.98/bbl, AECO C$3.36/mmbtu, CAD/USD FX rate 0.753; 2027 WTI US$76.65/bbl, AECO C$3.62/mmbtu, CAD/USD FX rate 0.753.

- Free cash flow ("FCF") is a non-GAAP financial measure comparable to cash flows from operating activities. FCF is comprised of fund flows from operations less drilling and development and exploration and evaluation expenditures. For further information refer to the "Non-GAAP Financial Measures and Other Specified Financial Measures" section in Vermilion's MD&A for the three and nine months ended September 30, 2024, available on SEDAR+ at www.sedarplus.ca.